Advertisement

-

Published Date

April 8, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

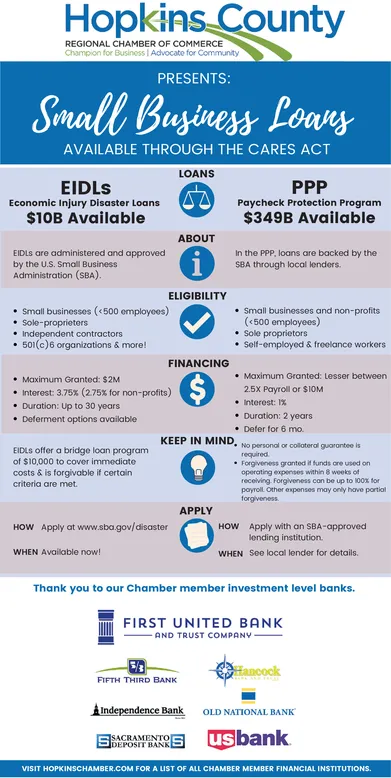

Hopkins County REGIONAL CHAMBER OF COMMERCE Champion for Businoss | Advocate for Community PRESENTS: Small Business Loary Loany AVAILABLE THROUGH THE CARES ACT LOANS PPP Paycheck Protection Program $349B Available EIDLS Economic Injury Disaster Loans $10B Available ABOUT EIDLS are administered and approved by the U.S. Small Business Administration (SBA). In the PPP, loans are backed by the SBA through local lenders. ELIGIBILITY Small businesses (500 employees) Sole-proprieters Independent contractors 501(c)6 organizations & more! Small businesses and non-profits (e500 employees) Sole proprietors Self-employed & freelance workers FINANCING Maximum Granted: Lesser between Maximum Granted: $2M Interest: 3.75% (275% for non-profits) Duration: Up to 30 years Deferment options available 2.5X Payroll or $1OM Interest: 1% Duration: 2 years Defer for 6 mo. KEEP IN MIND. No personal or colloteral guarantee ls %$4 EIDLS offer a bridge loan program of S10,000 to cover immediate costs & is forgivable if certain criteria are met. required * Forgiveness gronted it funds ore used on operating expenses within 8 weeks of receiving. Forgiveness con be up to 10Ox tor payroll. Other expenses may only have portial forgiveness. APPLY HOW Apply with an SBA-approved lending institution. HOW Apply at www.sba.gov/disaster WHEN Available now! WHEN See locoal lender for details. Thank you to our Chamber member investment level banks. FIRST UNITED BANK AND TRUST COMPANY FIFTH THIRD BANK Independence Bank OLD NATIONAL BANK usbank SACRAMENTO E EDEPOSIT BANK VISIT HOPKINSCHAMBER.COM FOR A LIST OF ALL CHAMBER MEMBER FINANCIAL INSTITUTIONS. Hopkins County REGIONAL CHAMBER OF COMMERCE Champion for Businoss | Advocate for Community PRESENTS: Small Business Loary Loany AVAILABLE THROUGH THE CARES ACT LOANS PPP Paycheck Protection Program $349B Available EIDLS Economic Injury Disaster Loans $10B Available ABOUT EIDLS are administered and approved by the U.S. Small Business Administration (SBA). In the PPP, loans are backed by the SBA through local lenders. ELIGIBILITY Small businesses (500 employees) Sole-proprieters Independent contractors 501(c)6 organizations & more! Small businesses and non-profits (e500 employees) Sole proprietors Self-employed & freelance workers FINANCING Maximum Granted: Lesser between Maximum Granted: $2M Interest: 3.75% (275% for non-profits) Duration: Up to 30 years Deferment options available 2.5X Payroll or $1OM Interest: 1% Duration: 2 years Defer for 6 mo. KEEP IN MIND. No personal or colloteral guarantee ls %$4 EIDLS offer a bridge loan program of S10,000 to cover immediate costs & is forgivable if certain criteria are met. required * Forgiveness gronted it funds ore used on operating expenses within 8 weeks of receiving. Forgiveness con be up to 10Ox tor payroll. Other expenses may only have portial forgiveness. APPLY HOW Apply with an SBA-approved lending institution. HOW Apply at www.sba.gov/disaster WHEN Available now! WHEN See locoal lender for details. Thank you to our Chamber member investment level banks. FIRST UNITED BANK AND TRUST COMPANY FIFTH THIRD BANK Independence Bank OLD NATIONAL BANK usbank SACRAMENTO E EDEPOSIT BANK VISIT HOPKINSCHAMBER.COM FOR A LIST OF ALL CHAMBER MEMBER FINANCIAL INSTITUTIONS.